Renko Bars Indikator

Wednesday, July 12, 2017 The ORIGINAL NinjaTrader Mean Renko Bars along with a Custom Renko Bar Marker. Two Price Action indicators for the Price of One! FAST, ACCURATE Simply the Best Renko Bars for Day Trading! The Mean Renko Bars are a totally re-engineered and improved variant of the traditional Renko bar. The Mean Renko has all power of the standard NinjaTrader Renko Bar, with the added benefits of proprietary intra-bar calculations.

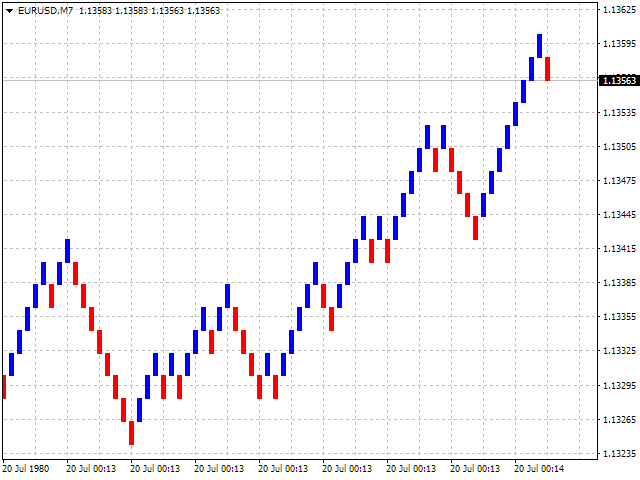

The Renko Bars MT4 Indicator is a powerful Forex price reversal strategy which is based on price reversal at extreme areas. Renko charts are typically concerned with price movements without factoring in time or volume.

The Mean Renkos are a core component of the Diversified Trading System. They are sure to improve any trader looking for smoother price action without sacrifices market structure intelligence. Includes: • True Price Wick Display • Intrabar Brick Generation • Current Bar Indicator Application • Opening Price Mean Plotting • Spurious Noise Filtering • Daily Reference Consistency The LogiCounter is a companion product that gives you predictive insight as to where the next Mean Renko Bar will Form. The LogiCounter provides a visual indication on the current Mean Renko bar to display where the price must go in order to complete the bar.

The price value is displayed, as well as a clear support / resistance block to show which direction the bar is likely to close. ' I like the confluence of utilizing my personal charts for a safe, valid entry, then monitor the Falcon and observe for dot, triangle, hash mark (which always follows and is reassuring). I also like observing the Eagle which assists greatly in staying with a trend despite pullbacks. The graphics help – everything ‘pops’ visually so nothing is missed and the eliminates noise, I can see price behavior (dojis, hammers, etc.) as bar develops during lower volatility.

DTS confirms entries and reinforces so I can stay with a certain move. Before I’d often have doubts and exit prematurely.

I needed something to help me stay in the trade.' 'I love the because they give you an edge over candlesticks. When markets go sideways candlesticks become smaller with upper and lower wicks -that’s market noise making it hard to read, now think about three candlesticks jumping up and down ranging 12 ticks from top to bottom. With Mean Renko Bars this could be just one Bar on the Eagle trend trader, when three Mean Renko Bars of 12 ticks move up or down, that’s 36 ticks - I have never done so well. Erich keeps you well informed and educates you, showing you what trades to take and what not to take.

He will share his trading knowledge with you in real-time and Ben will help with your program downloads. DTS is my last stop, I have been trading for 27 years and I can finally use my new found experience with the Falcon as I love taking the middle out of the markets as it swings.' Array ( [0] => WP_Post Object ( [ID] => 128903 [post_author] => 106 [post_date] => 2015-05-04 00:56:00 [post_date_gmt] => 2015-05-04 05:56:00 [post_content] => Know when the market territory is safe to enter and when it's time to take cover from the 'Heat.' The Geiger Counter was designed to enable you to easily add Buying and Selling Pressure analysis and Time and Sales data to any chart. With this indicator you can see the Pace of the Tape and Order Flow Analytics in an easy to understand Tape Speed Monitor format that allows you to quickly Read the Tape. Use the Geiger Counter's rate intensity histogram to determine reversal points.

A large block of spikes at a fast rate shows either buyers or sellers hitting their stops/removing their position. -The white line on the histogram and needle shows a running moving average of the buyers vs sellers. A rise/fall cross zero, above/below zero indicates if the Buyers or Sellers are in control. Additionally, the Geiger Counter gauge is an i nstantaneous indicator of order flow shift.  Advantages of the Geiger Counter: • Detect potential reversal points with increase of trade rate/intensity • Determine whether buyers/sellers are in control, and when control is shifting. • Pinpoint when to enter/exit your positions based on order flow shift.

Advantages of the Geiger Counter: • Detect potential reversal points with increase of trade rate/intensity • Determine whether buyers/sellers are in control, and when control is shifting. • Pinpoint when to enter/exit your positions based on order flow shift.